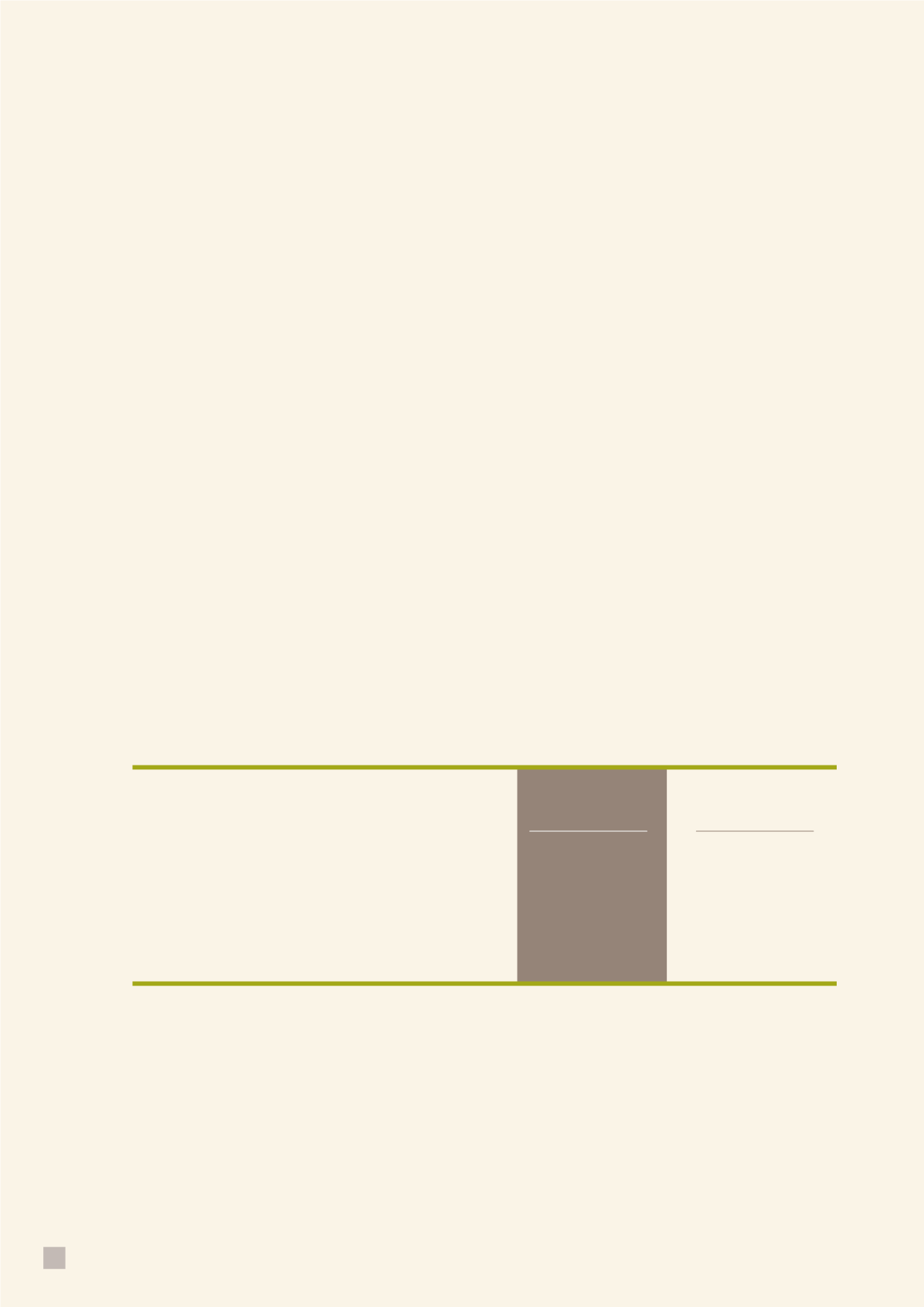

52

Pension Plans

DECEMBER 31

(In Thousands of New Taiwan Dollars)

Appointees’ retirement plan

Employees’ retirement plan

Accrued pension cost

2012

$5,365

8,591,825

$8,597,190

2011

$682,984

10,381,798

$11,064,782

The pension plan under the Labor Pension Act (LPA) is a defined contribution plan. Based on the LPA,

the rate of the Corporation’s monthly contributions to employees’ individual pension accounts is at 6% of

monthly salaries and wages.

The Corporation also has defined benefit plans under the Labor Standards Law (LSL). Benefits under

the plans are based on employee’s length of service and average basic pay in the last six months before

retirement (for the length of service before the LSL was enacted) or three months before retirement (for the

length of service after the LSL was enacted).

Personnel employed by the Corporation are referred to as either appointees or employees. The appointees’

retirement fund (ARF), established under the guidelines of the Ministry of Economic Affairs, requires

monthly contributions of amounts equal to 15% of monthly salaries and is administered by a pension plan

committee. The ARF is deposited in the committee’s name in a bank. The employees’ retirement fund

(ERF) entails monthly contributions by the Corporation to a fund at amounts equal to a fixed percentage of

15% of salaries and wages. The ERF is administered by a monitoring committee and is deposited in the

committee’s name in Bank of Taiwan.

On June 1, 1999, the Corporation stopped paying pensions out of the pension funds. Pensions paid by

the Corporation were charged instead to accrued pension cost. Pension payments totaled $18,998,592

thousand from June 1999 to December 2011 and $1,648,684 thousand in 2012, resulting in a decrease of

$20,647,276 thousand in accrued pension cost.

Under government regulations, the Corporation may recognize additional pension cost to meet the

additional pension obligation arising from the planned privatization, but the additional pension cost should

not affect the budgeted dividends to be distributed to the government.

Certain pension information is summarized as follows: